Whether you’re a first-time home buyer or a seasoned veteran, buying a new home can be a trying experience. However, following these simple suggestions can certainly help ease the tension.

1. Don’t get pre-qualified – get pre-approved:

No buyer should begin house hunting without knowing exactly what they are qualified to purchase, but getting pre-qualified doesn’t always mean that you can actually get a loan! Getting pre-qualified can save you a lot of time in looking at homes that are not within your price range, but getting pre-approved can save you a lot of heartache when you find the home of your dreams only to then find out that you can’t get a loan.

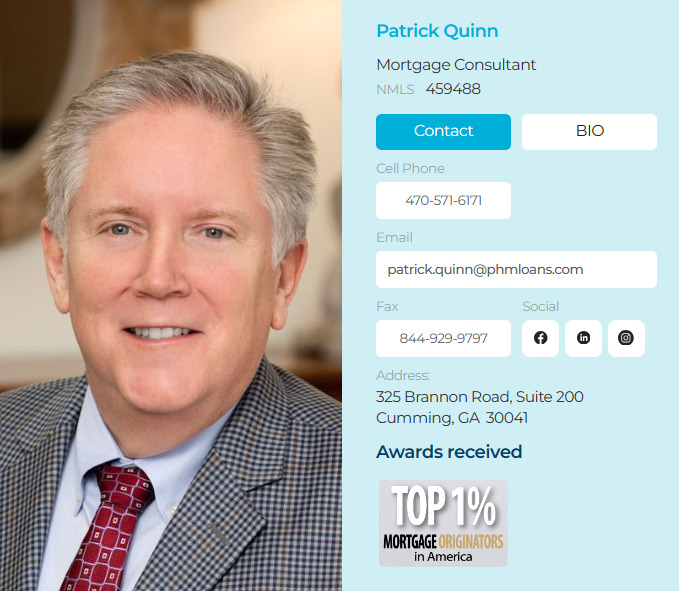

**Request a List of My Preferred Lenders

2. Establish your needs rather than your wants:

Everyone knows what they want, but more importantly you need to determine what you truly need before you begin looking at properties. This reduces wasted time spent looking at properties which perhaps are not suited to your lifestyle. When we, personally, begin to look for a new home we make a list of “must haves”, “like to haves” and “wouldn’t this be great” items. This will very easily help you target the right home.

3. Know where you need to be:

If you work outside of ForsythCounty you will want to determine the maximum distance you are willing to drive and limit your search to those communities.

Likewise, if you’re schedule allows you flexibility (such as telecommuting) you may prefer a home that is bit off the beaten path. I can help you to determine just where you want to be – and where you don’t – based on your specific requirements.

4. Work with an experienced Realtor:

It costs you nothing to work with an experienced agent, and the benefits you gain from their experience can help you immensely when you are making the single most important financial purchase in your life. Don’t let an in-experienced agent use your purchase for practice. Again, I would be more than happy to help you through the process.

5. BUT, MOST IMPORTANTLY…. Two things I tell all of our customers:

1) Always have your home inspected. It doesn’t matter how much you like or trust your builder. He cannot be there every minute of every day to oversee every stick of wood that’s goes into your home. It is sub-contractors who really build your home. There are good ones and bad ones, and good ones can have bad days!

**Request a List of My Preferred Home Inspectors

2) Buy owner’s title insurance. With the recent changes made to the standard Georgia real estate contract , this is more important than ever! Title Insurance will protect your investment should there prove to be any question as to the validity of deed history. The bank will require that you purchase a policy for them at closing so make sure you have taken care of yourself as well. I have always suggested this, and do so even more strongly should you be buying in a rural area.

My clients needs are my number one priority and putting them first is how I distinguish myself from other agents in my area.

My clients needs are my number one priority and putting them first is how I distinguish myself from other agents in my area.